All Categories

Featured

Table of Contents

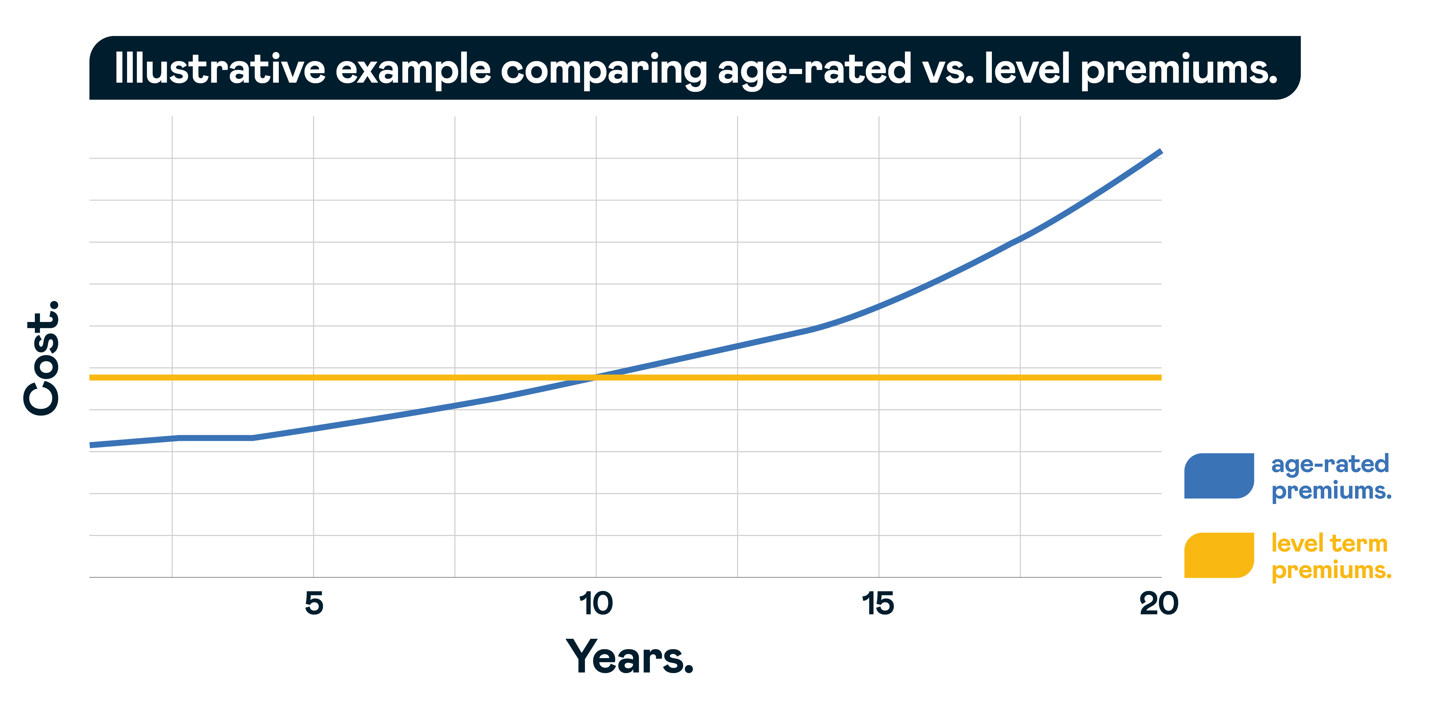

A level term life insurance policy policy can give you peace of mind that the individuals that depend on you will have a survivor benefit throughout the years that you are planning to support them. It's a way to aid deal with them in the future, today. A degree term life insurance policy (in some cases called level premium term life insurance policy) policy supplies protection for an established number of years (e.g., 10 or twenty years) while keeping the costs payments the exact same for the duration of the policy.

With degree term insurance coverage, the cost of the insurance coverage will remain the same (or potentially lower if dividends are paid) over the regard to your plan, usually 10 or two decades. Unlike permanent life insurance policy, which never ever runs out as long as you pay costs, a level term life insurance policy policy will certainly end eventually in the future, normally at the end of the period of your degree term.

What is 10-year Level Term Life Insurance? Key Information for Policyholders

As a result of this, many individuals make use of long-term insurance policy as a stable financial preparation tool that can serve lots of demands. You might be able to convert some, or all, of your term insurance coverage throughout a set duration, normally the very first ten years of your plan, without requiring to re-qualify for insurance coverage also if your health and wellness has actually changed.

As it does, you might wish to include to your insurance protection in the future. When you first get insurance policy, you might have little cost savings and a big mortgage. Eventually, your cost savings will certainly grow and your home loan will diminish. As this happens, you might wish to ultimately reduce your survivor benefit or think about converting your term insurance coverage to a long-term plan.

Long as you pay your costs, you can relax simple understanding that your liked ones will receive a fatality advantage if you die throughout the term. Numerous term policies permit you the capability to transform to irreversible insurance policy without needing to take one more wellness test. This can enable you to take benefit of the added benefits of a long-term plan.

Degree term life insurance policy is one of the most convenient courses into life insurance policy, we'll discuss the advantages and downsides so that you can select a strategy to fit your needs. Degree term life insurance coverage is the most common and standard type of term life. When you're searching for short-lived life insurance policy strategies, level term life insurance is one path that you can go.

You'll load out an application that has basic individual details such as your name, age, etc as well as an extra in-depth questionnaire concerning your clinical history.

The brief solution is no. A degree term life insurance plan doesn't build money worth. If you're seeking to have a plan that you're able to withdraw or borrow from, you might check out irreversible life insurance policy. Entire life insurance plans, for instance, let you have the convenience of survivor benefit and can accumulate cash worth over time, implying you'll have extra control over your benefits while you're to life.

What is the Difference with 20-year Level Term Life Insurance?

Cyclists are optional provisions included to your policy that can provide you additional advantages and protections. Anything can occur over the program of your life insurance policy term, and you want to be prepared for anything.

There are circumstances where these advantages are constructed right into your policy, however they can also be available as a different enhancement that calls for additional settlement.

Latest Posts

1 Life Funeral Cover Quotes

Instant Whole Life Insurance Quote

New State Regulated Life Insurance Program To Pay Final Expenses