All Categories

Featured

Table of Contents

You can borrow versus the cash worth of your plan for points like tuition settlements, emergencies and also to supplement your retirement income (Legacy planning). Remember, this still is considered a funding, and if it's not paid off before you die, then your survivor benefit is reduced by the quantity of the car loan plus any exceptional interest

Basically, a cyclist is used to tailor your plan to fit your needs. If you're terminally ill, a sped up death advantage cyclist might pay out a part of your fatality benefit while you're still active. You can use the payment for points like clinical expenditures, amongst various other uses, and when you pass away, your beneficiaries will get a decreased life insurance policy advantage considering that you made use of a part of the plan currently.

Speak with your American Household Insurance agent to see if your American Domesticity Insurance coverage Company policy has living advantages. In the meanwhile, take a look at our life insurance policy coverages to see which choice is best for you and your liked ones. This information represents just a quick summary of insurance coverages, is not component of your policy, and is not a guarantee or assurance of protection.

Insurance policy conditions might apply. Exclusions might relate to policies, recommendations, or riders. Insurance coverage might vary by state and may be subject to transform. Some items are not offered in every state. Please read your policy and call your representative for support. Policy Forms: ICC17-225 WL, Plan Type L-225 (ND) WL, Plan Type L-225 WL, Policy FormICC17-225 WL, Policy Type L-226 (ND) WL, Policy Kind L-226 WL, Policy Kind ICC17-227 WL, Policy Type L-227 (ND) WL, Policy Form L-227 WL, ICC21 L141 MS 01 22, L141 ND 02 22, L141 SD 02 22.

How can Beneficiaries protect my family?

Fatality advantages are normally paid in a lump sum settlement., health and wellness insurance, and tuition. At the very least 3 in 4 American grownups showed they have some kind of life insurance policy; nonetheless, females (22%) are twice as likely as guys (11%) to not have any life insurance.

This might leave less cash to spend for expenditures. Each time when your enjoyed ones are already dealing with your loss, life insurance can help alleviate some of the financial concerns they may experience from lost revenue after your passing and assistance provide an economic safeguard. Whether you have a 9-to-5 task, are self-employed, or have a local business, your existing earnings could cover a part or every one of your family's day-to-day requirements.

44% responded that it would take much less than 6 months to experience monetary difficulty if the key breadwinner passed away. 2 If you were to pass away unexpectedly, your various other family participants would still require to cover these ongoing family expenses even without your income. The life insurance policy survivor benefit can aid change earnings and ensure financial security for your loved ones after you are no more there to supply for them.

What are the benefits of Policyholders?

Funeral services can be pricey. Managing this monetary stress and anxiety can contribute to the emotional strain your household could experience. Your family can use a few of the survivor benefit from your life insurance policy plan to aid pay for these funeral service costs. The plan's beneficiary could direct some of the survivor benefit to the funeral home for final expenditures, or they can pay out-of-pocket and make use of the death advantage as compensation for these expenses.

The "Human Life Value" (HLV) idea relates to life insurance policy and economic planning. It stands for a person's value in terms of their economic contribution to their family members or dependents.

What is Income Protection?

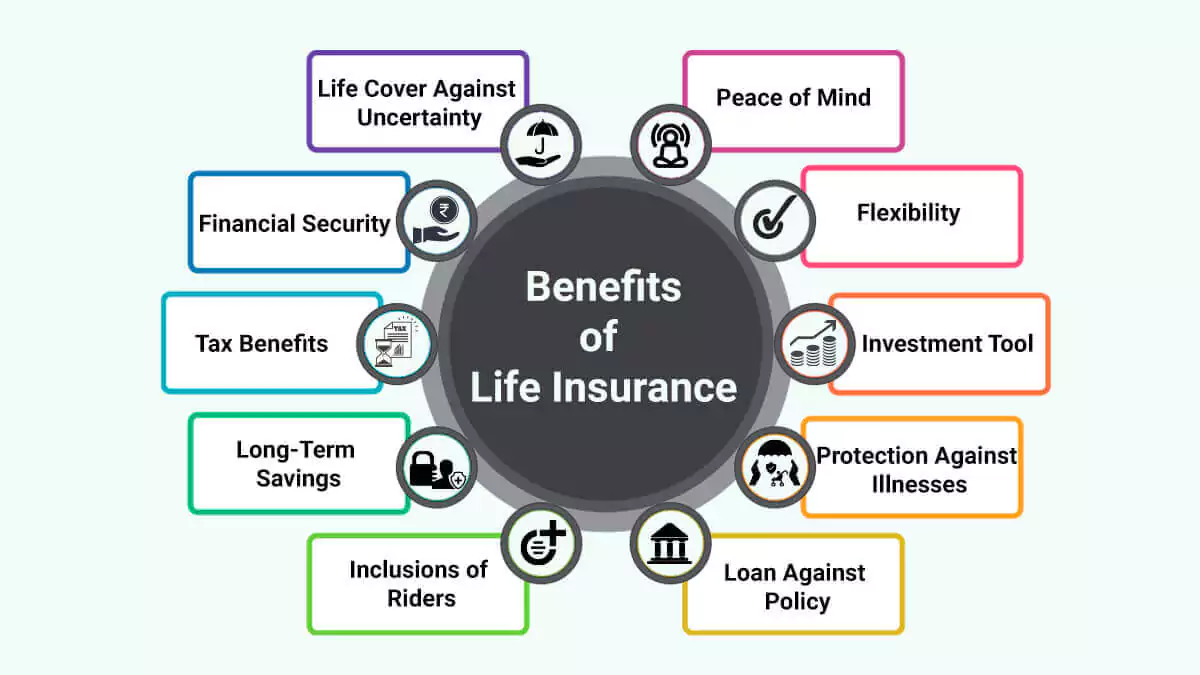

Eighth, life insurance can be used as an estate preparation tool, aiding to cover any needed inheritance tax and last expenditures - Premium plans. Ninth, life insurance policy policies can offer particular tax advantages, like a tax-free survivor benefit and tax-deferred money value accumulation. Life insurance policy can be a crucial part of shielding the monetary protection of your loved ones

Talk to among our economic specialists regarding life insurance policy today. They can assist you examine your needs and discover the appropriate plan for you. Passion is charged on car loans, they may produce an earnings tax obligation responsibility, decrease the Account Worth and the Survivor Benefit, and might create the policy to gap.

What is the difference between Final Expense and other options?

The Federal Federal government developed the Federal Worker' Team Life Insurance Policy (FEGLI) Program on August 29, 1954. It is the largest team life insurance policy program on the planet, covering over 4 million Federal workers and retired people, along with much of their relative. Most staff members are qualified for FEGLI insurance coverage.

It does not construct up any kind of cash money value or paid-up worth. It contains Basic life insurance policy protection and 3 alternatives. In many cases, if you are a new Federal staff member, you are automatically covered by Basic life insurance and your pay-roll office subtracts premiums from your income unless you forgo the protection.

You should have Standard insurance in order to elect any of the alternatives. Unlike Basic, registration in Optional insurance is not automated-- you have to act to elect the options (Long term care). The price of Basic insurance policy is shared in between you and the Government. You pay 2/3 of the overall price and the Government pays 1/3.

Why is Income Protection important?

You pay the full cost of Optional insurance, and the expense depends upon your age. The Workplace of Federal Personnel' Team Life Insurance (OFEGLI), which is an exclusive entity that has a contract with the Federal Federal government, processes and pays insurance claims under the FEGLI Program. The FEGLI Calculator permits you to figure out the face worth of numerous combinations of FEGLI coverage; compute premiums for the various mixes of insurance coverage; see just how picking different Options can alter the quantity of life insurance policy and the premium withholdings; and see just how the life insurance policy brought into retirement will change in time.

Chances are you might not have adequate life insurance coverage for on your own or your enjoyed ones. Life events, such as getting wedded, having youngsters and buying a home, may trigger you to require even more defense.

You will pay the very same month-to-month costs regardless of the variety of kids covered. A kid can be covered by only one parent under this Plan. You can enroll in Optional Life insurance policy and Dependent Life-Spouse insurance policy throughout: Your preliminary enrollment; Open enrollment in October; orA special qualification scenario. You can enroll in Dependent Life-Child insurance coverage during: Your initial registration; orAnytime throughout the year.

Think of your age, your monetary circumstance, and if you have individuals who rely on your revenue. If you choose to buy life insurance policy, there are some points to think about. You might desire to take into consideration life insurance if others depend upon your revenue. A life insurance plan, whether it's a term life or whole life policy, is your personal building.

How do I get Term Life?

Here are a number of disadvantages of life insurance policy: One negative aspect of life insurance policy is that the older you are, the extra you'll spend for a plan. This is because you're most likely to pass away during the policy duration than a younger policyholder and will, consequently, set you back the life insurance company more money.

Latest Posts

1 Life Funeral Cover Quotes

Instant Whole Life Insurance Quote

New State Regulated Life Insurance Program To Pay Final Expenses